1. Protect Against High Healthcare Costs

In Trinidad and Tobago, out-of-pocket healthcare spending accounts for nearly 46% of total health expenditure (PAHO, 2021).

Studies show that individuals with health insurance save significantly on medical expenses, particularly during emergencies or for chronic disease management.

Research from the Commonwealth Fund reveals that insured individuals are 60% less likely to delay or avoid medical care due to costs.

2. Access to Preventive Care and Regular Check-ups

Non-communicable diseases (NCDs), including diabetes and heart disease, are leading causes of illness in Trinidad and Tobago.

Health insurance ensures affordability and access to regular screenings, reducing the likelihood of expensive complications.

3. Enhanced Life Expectancy and Quality of Life

Life expectancy in Trinidad and Tobago has risen to 73.6 years (PAHO, 2024), highlighting the importance of sustained access to quality healthcare.

Insurance enables individuals to afford medications, therapies, and other essential services that improve both lifespan and overall well-being.

4. Financial Security for Families

Without insurance, families risk depleting savings or incurring debt due to medical emergencies.

According to a report by the World Health Organization, health insurance significantly reduces catastrophic health expenditures, ensuring financial stability during unexpected health crises.

5. Promote Public Health and System Efficiency

Health insurance coverage reduces the burden on public healthcare systems by spreading costs and improving resource allocation.

A study from the Journal of Public Health Management found that insured populations contribute to better public health outcomes through higher rates of immunization, routine care, and chronic disease management.

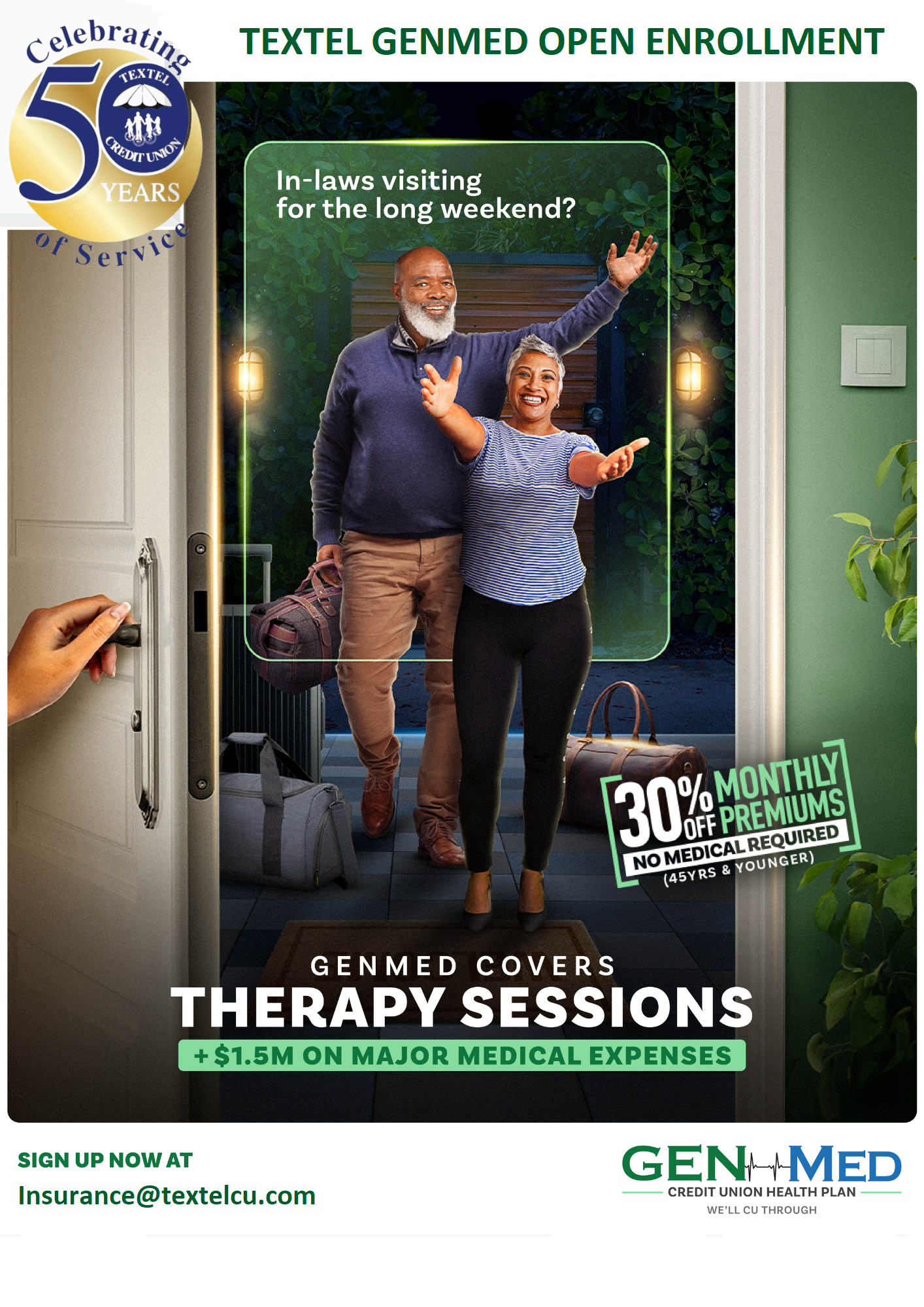

6. Peace of Mind

Knowing you and your family are covered for a range of medical needs provides unparalleled peace of mind.

Saving Costs with Health Insurance

Health insurance is not just about covering expenses; it’s about saving lives and money:

- A Harvard Medical School study found that families with insurance save up to 40% on overall medical expenses.

- The long-term savings from preventive care can significantly lower healthcare costs over time.

7. Secure Coverage Before It’s Too Late

As you age, obtaining health insurance becomes more challenging and expensive. Enrolling while you're younger not only ensures immediate protection but also guarantees continuity of coverage as you grow older.

In Trinidad and Tobago, the aging population (65 years and older) increased from 6.9% in 2010 to 10.4% in 2021 (PAHO, 2021). This trend underscores the importance of planning for future health needs now. Early enrollment also provides access to preventive care that reduces the risk of costly health issues later in life.

Without coverage, older adults often face higher out-of-pocket expenses due to age-related illnesses and pre-existing conditions. Studies show that individuals with insurance are 50% more likely to receive timely treatment, reducing the financial and emotional strain of medical emergencies.